If you are doing business in Canada and the EU, you may be required to collect two sets of taxes on many of your invoices. While this may seem like a complicated procedure, Harvest invoices make these calculations very simple. Harvest is able to calculate both simple and compound taxes in dual tax fields.

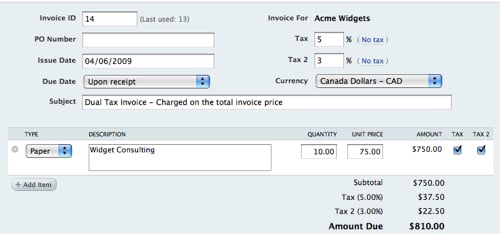

Invoicing with Simple Tax Calculation

In a Simple Tax situation, both federal and provincial taxes are applied equally to the principal invoice total. For example, on the invoice below, the pre-tax total is $750, and the 5% GST and 3% PST are applied equally to the subtotal, for a total amount of $810.00. This type of dual taxation is supported in Harvest invoices by going to Invoices > Configure and selecting ‘Simple Tax’. If you are doing business in Canada outside of Quebec and PEI, you should use this setting.

Simple Tax: Tax 2 is calculated as a percentage of the subtotal.

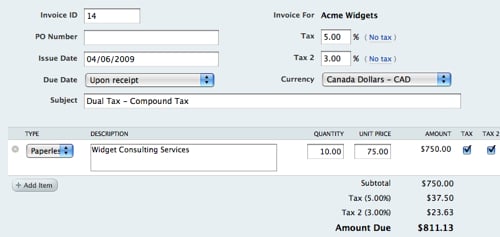

Invoicing with Compound Tax Calculation

In a Compound Tax situation, the total cost of a product or service is taxed federally, then the total of that amount, including the federal tax, is taxed provincially a second time. For example, in the case below the invoice $750 is taxed at 5% GST, for a subtotal of $787.50. Then, a second compound tax of 3% PST on the subtotal, in the amount of $23.63, is added to the total bill, for a final amount due of $811.13. This type of dual taxation is supported in Harvest invoices by going to Invoices > Configure and selecting ‘Compound Tax’. If you are doing business in Canada, in Quebec or PEI, you should select this tax setting.

Compound Tax: Tax 2 is calculated as a percentage of the subtotal + tax 1.

Important Definitions

- Compound Tax – Also known as a stacked tax. Applying a second, provincial tax, on the total of the invoice including the Federal tax. In Canada, both Quebec and Prince Edward Island require a second, compound tax to be charged on goods and services.

- GST – Goods and Services Tax, charged Federally on good and services in Canada and the EU.

- PST – Provincial Sales Tax, charged locally on goods and services and can be applied as either a Simple or Compound tax depending on the geographic location.